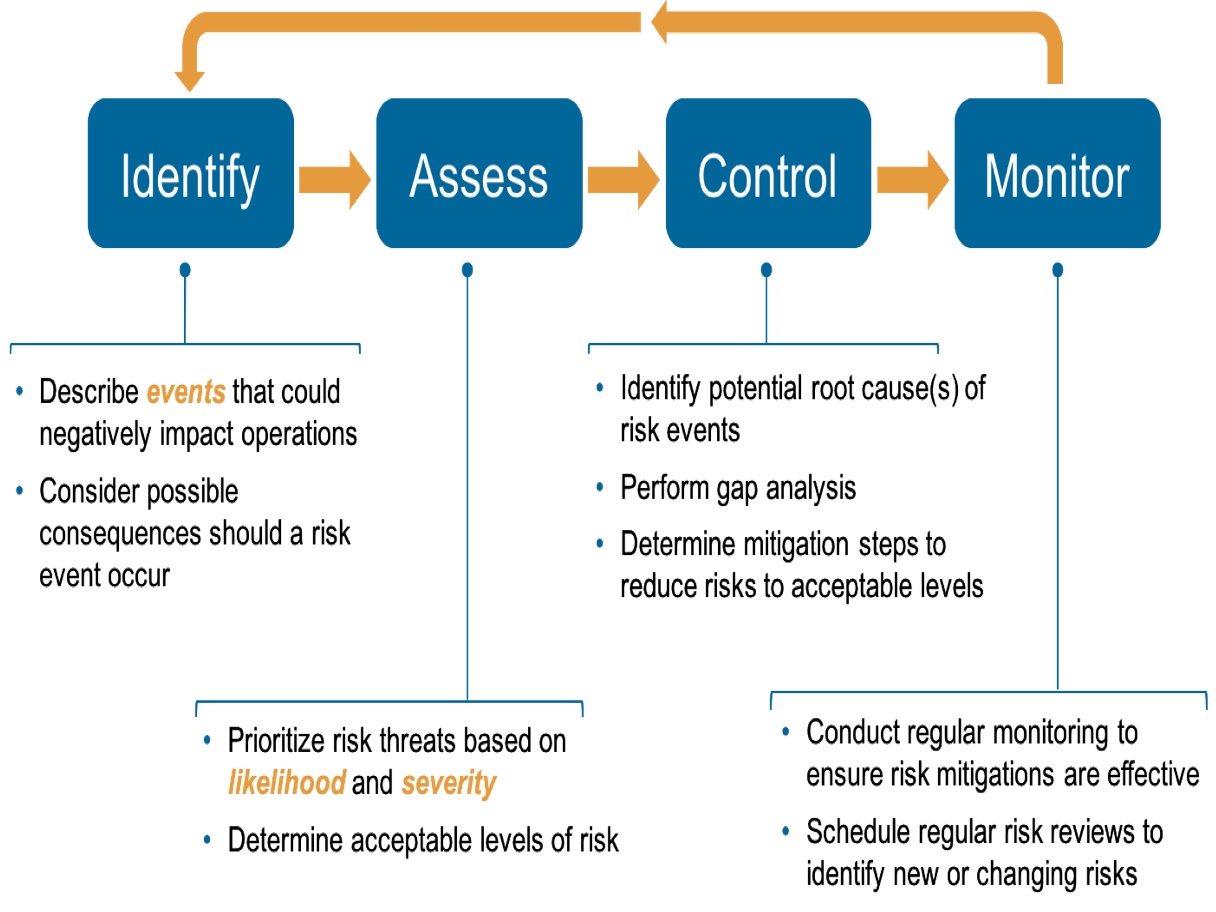

We left the hard problem of showing that this can actually be put into practice until now. Not bad work for just four short articles! However, this is just theory. Show that our approach was fully compliant with Basel II.Compute the operational risk exposure by simply summing up operational risk associated with each indicator 1.Estimate the operational risk associated which each indicator by measuring the likelihood of it falling outside of its stated error tolerance and the potential impact of such an event.Importantly, we were able to tie these indicators directly to the overall corporate goals and objectives. Express operational performance and risk using systematically defined Key performance indicator (KPI) and Key risk indicator (KRI).Using a few simple propositions, we were able to:

#OPERATIONAL RISK MANAGER SERIES#

Previous articles in this series were: Operational Risk 101: The Basic Definitions Operational Risk and the Basel II Accords Operational Risk in Terms of Operational Performance Operational Risk 101: Tackling Basel II. Putting words into action – delivering risk performance within agreed tolerances at the sharp end – day after day.In the four previous articles, we proposed a comprehensive framework to express, measure, and monitor operational risk in terms of the operational performance. Operational Risk Management: Core Services Enhance organisational capability in ensuring safety of staff.Greater confidence in the planning or delivery of a capital investment preventing delays and cost overruns.Enhancement of risk-based decision-making and improving the risk management capability of staff.Validating and improving the reliability and effectiveness of business operations and the operation of the risk management framework.As such, operational risk captures business continuity plans, environmental risk, crisis management, process systems and operations risk, people related risks and health and safety, and information technology risks." Operational Risk Management: Value Operational Risk is described by the Basel Committee on Banking Supervision as "the risk of loss resulting from inadequate or failed internal processes, people and systems, or from external events. America Uruguay Uzbekistan Venezuela Vietnam Zambia Zimbabwe eSwatini/SwazilandĪs a fully integrated risk practice, we have the size and capability to address all risk issues and deliver end-to-end solutions Rep.) Costa Rica Croatia Cyprus Czech Republic Côte d'Ivoire Denmark Dominican Republic Ecuador El Salvador Equatorial Guinea Estonia Finland France Gabon Georgia Germany Ghana Gibraltar Global Greece Guatemala Guinea Honduras Hong Kong SAR, China Hungary Iceland India Indonesia Interaméricas Ireland (Republic of) Isle of Man Israel ישראל Italy Jamaica Japan Kazakhstan Kenya Kosovo Laos Latvia Liberia Liechtenstein Lithuania Luxembourg Macedonia Madagascar Malawi Malaysia Maldives Malta Mauritius Middle East Region Middle East Bahrain Egypt Iraq Jordan Kuwait Lebanon Libya Oman Qatar Saudi Arabia United Arab Emirates West Bank Gaza Moldova Mongolia Montenegro Mozambique México Mexico Namibia Netherlands Netherlands Antilles New Caledonia New Zealand Nicaragua Nigeria Norway Pakistan Panama Papua New Guinea Paraguay Peru Philippines Poland Portugal Romania Rwanda Senegal Serbia Singapore Slovakia Slovenia South Africa South Korea Spain Sri Lanka Sweden Switzerland Taiwan 臺灣 Tanzania Thailand Trinidad and Tobago Turkey Türkiye Uganda Ukraine Україна United Kingdom UK United States US USA U.S. Afrique Francophone Albania Andorra Angola Argentina Armenia Australia Austria Azerbaijan Bahamas Barbados Belgium Belgique België Bermuda Bolivia Bosnia and Herzegovina Botswana Brasil British Virgin Islands Brunei Bulgaria Cambodia Cameroon Canada Cape Verde Caribbean Cayman Islands Central and Eastern Europe Chad Channel Islands Chile China Colombia Congo (Brazzaville) Congo (Dem.

0 kommentar(er)

0 kommentar(er)